On February 20, 2020, China Market Regulation News published an article authored by Mr. Wu Zhenguo, the Director-General of the Anti-Monopoly Bureau of China’s State Administration for Market Regulation (“SAMR”), Promote Fair Competition and Serve Reform Development: The Overview of Antitrust Work of 2019[1]. In this article, Mr. Wu summarized and reviewed the antitrust enforcement of 2019 from different perspectives. According to the article, China’s antitrust enforcement authorities (including SAMR and provincial administrations for market regulation (“AMR”)) officially launched 103 antitrust investigations in 2019, and 44 of them were closed with a total fine of CNY 320 million. Specifically, formal investigations were launched in 28 monopoly agreement cases (12 of them were closed), 15 abuse of dominance cases (4 of them were closed), 24 administrative monopoly cases (12 of them were corrected) and 36 gun-jumping cases (16 of them were closed). This article will focus on the monopoly agreement cases and abuse of dominance cases closed in 2019.

I. Overview

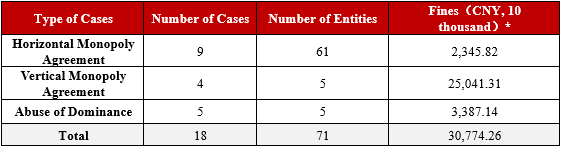

According to the adminstrative decisions[2] published on the website of SAMR, at least 70[3] companies, industry associations and individuals received relevant decisions from China’s antitrust enforcement authorities in more than 18 horizontal monopoly agreement cases, vertical monopoly agreement cases and abuse of dominance cases in 2019. Among them, five entities in four different cases were exempted from punishment as the investigation was suspended or terminated, and the rest 65 entities in other cases were imposed a fine ranging from CNY 21,900 to CNY 162.8 million.

Table 1 - The Overview of Antitrust Investigation in 2019

*Round to the nearest hundredth. Same below.

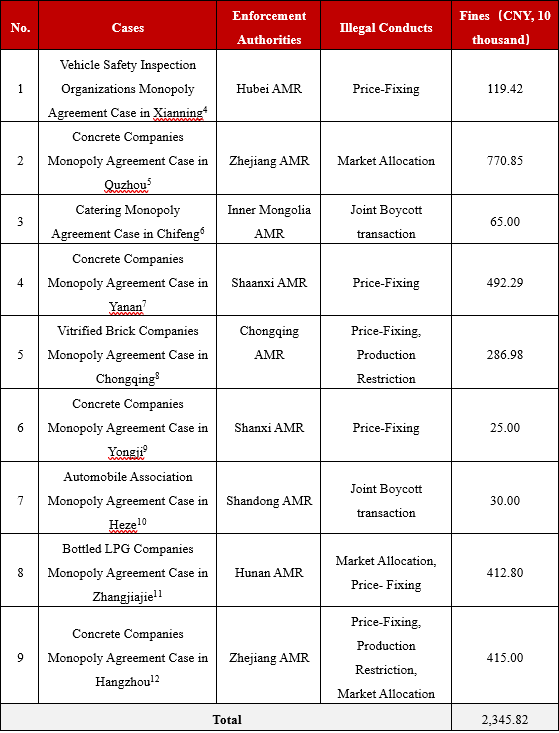

A. Horizontal Monopoly Agreement Cases

In 2019, horizontal monopoly agreements between competitors, such as price-fixing agreement and market allocation agreement, were still the priority of antitrust enforcement in 2019. The AMR of Hubei, Zhejiang, Inner Mongolia, Shaanxi, Chongqing, Shanxi, Shandong and Hunan have launched nine investigations in connection with horizontal monopoly agreement. Such investigations covered the industries such as building material, vehicle inspection, catering, car exhibition, bottled gas, etc. Among those nine investigations, Zhejiang AMR launched two investigations in the concrete industry, Inner Mongolia AMR launched the first investigation relating to catering industry since the Anti-Monopoly Law (“AML”) came into effect in 2018 and Shandong AMR launched one investigation relating to jointly boycott transaction conducted by industry association.

Table 2 – The Overview of Horizontal Monopoly Agreement Cases in 2019

B. Vertical Monopoly Agreement Cases

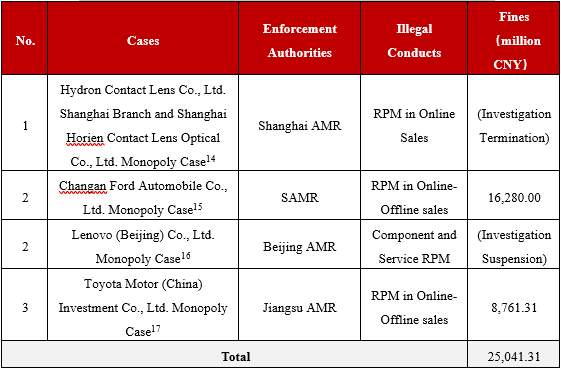

In 2019, SAMR published four decisions relating to vertical monopoly agreement and all of them involved resale price maintenance (“RPM”) behavior, which is explicitly prohibited under Article 14 of AML[13].

Table 3 – The Overview of Vertical Monopoly Agreement Cases in 2019

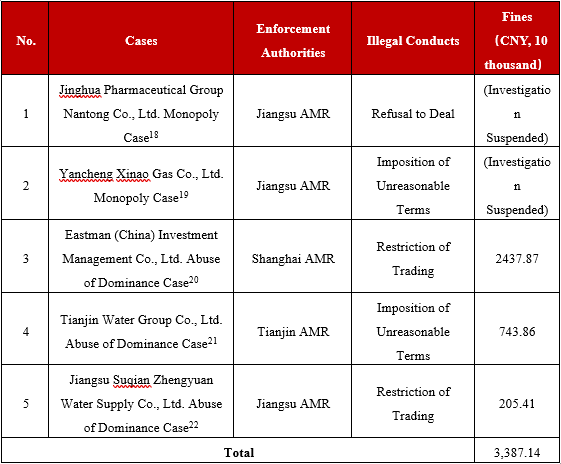

C. Abuse of Dominance Cases

In 2019, five abuse of dominance cases were closed, and three of them were closed with administrative sanctions and the rest two were closed with suspension of investigation. Among these five cases, three of them involved public utility enterprises, and the other two involved pharmaceutical enterprises and chemical enterprise respectively. These illegal conducts in such abuse of dominance cases included refusal to deal, imposition of unreasonable terms and restriction of trading.

Table 4 – The Overview of Abuse of Dominance Cases in 2019

II. Highlights of and Observations

A. Building Material Industry Remains the Priority of Antitrust Enforcement

It can be seen from Table 2 above that most horizontal monopoly agreement cases investigated in 2019 were in the building material industry. Five out of nine horizontal monopoly agreement cases involved building material industry and four out of such five building material industry cases involved the concrete industry. By far, China’s antitrust enforcement authorities have imposed fines totaled up to CNY 200 million in at least 19 monopoly cases in the building material industry since the effectiveness of AML.

Building material industry, as one of the industries vital to the national well-being and the people’s livelihood, has hold the attention of antitrust enforcement authorities for a long time. On December 27, 2018, Mr. Zhang Mao, the Minister of SAMR at that time, emphasized during an interview that antitrust enforcement authorities would focus on public utilities, APIs, building material and other areas that vital to the people’s livelihood in 2019, strengthen the enforcement targeting at monopoly agreement and abuse of dominance, correct administrative monopoly behaviors and publish a series of typical antitrust cases[23]. In the meantime, warning meetings, training sessions and other events targeting at building material industry were periodically held by SAMR and provincial AMRs in 2019. For example:

a) On April 24, 2019, the Anti-Monopoly Bureau of SAMR held a building material industry warning meeting in Hangzhou. 3 national building material associations, 15 provincial concrete industry associations, 6 concrete suppliers and 10 provincial antitrust enforcement authorities attended this meeting .[24]

b) On July 19, 2019, the Hubei concrete industry antitrust training session was held in Wuhan. An official from the Anti-Monopoly Division of Hubei AMR delivered a speech named Industry Self-Discipline and Monopolistic Behaviors. About 150 attendees including members from Hubei Concrete Industry Association Council and representatives of several concrete suppliers attended this training session[25]. On August 27, 2019, Hubei AMR gave another training session to promote the education of the AML among numerous enterprises active in various sectors including the building material industry. Under the organization by Hubei Ready-mixed Concrete Industry Association, tens of concrete suppliers attended this event[26].

In addition, it is reported that Shaanxi AMR has launched a formal investigation against several local concrete suppliers for price collusion, in which the suppliers conducted collusive price increase for 13 times within two years[27]. Guangdong AMR held an administrative hearing on December 29, 2019, for the Maoming Concrete Monopoly Case and planned to impose a total fine of approximately CNY 7.65 million upon the involved companies[28]. However, although the concrete industry is under such strict supervision, some companies still fail to realize the antitrust risk. For example, on July 18, 2019, a mining company which owns two concrete subsidiaries issued a press release through its WeChat official account saying that the company had actively colluded with local concrete suppliers and adjusted product price to expand the market and maintain stable sales[29].

B. Public Utility Enterprises Face High Antitrust Risks

Public utility enterprise is another priority of antitrust enforcement authorities in 2019. Usually, the investigation of abuse of dominance case should follow certain analysis patterns: definition of relevant market – determination of dominant market position – finding of behavior – the eliminative or restrictive effect on competition. However, for public utility enterprises such as water supply and gas supply companies, there is usually only one supplier in a certain area. Given the natural monopoly status of public utility enterprise, the definition of relevant market and finding of the dominant market position would be much easier in the public utility enterprise monopoly cases. Therefore, public utility enterprises are facing higher risks of violating the AML in daily operations. For instance, illegal conducts such as restriction of trading and imposition of unreasonable terms involved in those three cases investigated by Jiangsu AMR and Tianjin AMR in 2019 are also common in previously investigated monopoly cases involving public utility enterprises.

In addition to the risk of administrative sanctions, monopolistic behaviors may also expose the public utility enterprises to civil litigation risks. For instance, a water supply company was sued before Nanning Intermediate People’s Court in Guangxi Zhuang Autonomous Region in 2019 for abuse of dominance. In this suit, the water supply company lost the first trial[30].

C. Different Situation for RPM Cases

Among the four RPM cases published in 2019, the investigation of Hydron Contact Lens Co., Ltd. Shanghai Branch and Shanghai Horien Contact Lens Optical Co., Ltd. monopoly case (“Contact Lens Case”) was terminated, and the investigation of Lenovo (Beijing) Co., Ltd. monopoly case was suspended. In the Contact Lens Case, the antitrust enforcement authority launched the formal investigation on November 2, 2017, after more than 1-year’s preliminary investigation. The parties applied for suspension of investigation on November 13, 2017, with a series of rectification measures, such as setting up a “monopoly-prevention leader group”, establishing “case by case review system” and holding periodical compliance training seminars, etc. As a result, the antitrust enforcement authority suspended this investigation on March 6, 2018, and finally terminated the investigation on April 24, 2019.

By contrast, Changan Ford Automobile Co., Ltd. (“Changan Ford”) and Toyota Motor (China) Investment Co., Ltd.(“Toyota”) were fined CNY 162.8 million and CNY 87.6 million respectively, which accounts for 80% of the total fine on monopoly agreement cases and abuse of diminance cases imposed in 2019. The Changan Ford case is the only case directly investigated by SAMR itself among all monopoly agreement cases and abuse of dominance cases in 2019.

According to the publicly available information, Changan Ford had conducted RPM by restricting downstream distributors’ minimum resale prices in Chongqing Province since 2013. The RPM conducted by Toyota also lasted over two years. As early as 2014, many well-known automobile manufacturers, distributors and component suppliers have been investigated by the antitrust enforcement authorities in China, but RPM still can be found in the automobile industry in recent days. This means strict supervision should be maintained for a long time.

D. Highest Fine for abuse of dominance case in 2019: Eastman Monopoly Case

The fine imposed upon Eastman (China) Investment Management Co., Ltd. (“Eastman”) is the largest among the abuse of dominance cases investigated by China’s antitrust enforcement authorities in 2019. The public version of the penalty decision of this case has 27 pages, with more than 10 thousand Chinese words. The enforcement authority conducted a detailed analysis on the definition of relevant market and the finding of dominant market position and further determined that the “take-or-pay agreement” and “most-favored-nation treatment agreement” were exclusive agreements which would have a restrictive effect upon its trade counterparties and would cause severe foreclosure effect in the relevant market.

Also, economic analysis was applied in this case to resolve several sophisticated issues. For example, besides the substitution analysis, the hypothetical monopolist test recommended in the Guidelines of the Anti-monopoly Commission of the State Council for the Definition of Relevant Market was also applied to define the relevant market. Specifically, the Shanghai AMR applied a critical loss method to analyze the market data before defining the relevant market in this case. In the meanwhile, the application of the Lerner index also helped to assess the anti-competition effect. The adoption of various economic analysis methods made the analysis and definition in the sanction decision more convincing and professional and demonstrated that the antitrust law enforcement capability has been greatly improved in recent years.

[1]See http://www.cicn.com.cn/zggsb/2020-02/20/cms123961article.shtml.

[2]Including penalty decisions, investigation suspension decisions, investigation termination decisions and other decisions.

[3]13 companies was involved in the concrete companies monopoly agreement case in Hangzhou. However, only 12 of them were fined in 2019. On January 15, 2020, Zhejiang AMR finally decided it would not impose fine on Hangzhou Yifang Concrete Co., Ltd.

[4] See http://www.samr.gov.cn/fldj/tzgg/xzcf/201904/t20190404_292577.html.

[5] See http://www.samr.gov.cn/fldj/tzgg/xzcf/201905/t20190529_301526.html.

[6]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201908/t20190820_306149.html.

[7]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201908/t20190830_306396.html.

[8]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201908/t20190821_306163.html.

[9]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201910/t20191008_307206.html.

[10]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201911/t20191101_308050.html.

[11] See http://www.samr.gov.cn/fldj/tzgg/xzcf/201912/t20191211_309148.html.

[12] See http://www.samr.gov.cn/fldj/tzgg/xzcf/202002/t20200207_311212.html.

[13]RPM is stated as “fixing the price of commodities for resale to third party” and “fixing the lowest price for resale of commodities to third party” in Article 14 of AML.

[14]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201905/t20190521_293971.html.

[15]See http://www.samr.gov.cn/xw/zj/201906/t20190605_302109.html.

[16]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201911/t20191115_308573.html.

[17]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201912/t20191227_309552.html.

[18]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201903/t20190308_291810.html.

[19]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201903/t20190325_292290.html.

[20]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201904/t20190429_293241.html.

[21]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201907/t20190712_303427.html.

[22]See http://www.samr.gov.cn/fldj/tzgg/xzcf/201911/t20191126_308830.html.

[23]Zhao Wenjun, Optimizing Business Environment and Releasing Potential Consumption: Exclusive Interview with the Minister of SAMR, http://www.xinhuanet.com/politics/2018-12/27/c_1123915286.htm.

[24] Anti-Monopoly Bureau of SAMR, Anti-Monopoly Bureau Holds Building Material Industry Warning Meeting, http://www.samr.gov.cn/fldj/sjdt/gzdt/201904/t20190424_293109.html.

[25]Yao Mengxin, Hubei Concrete Industry Holds Antitrust Training, http://scjg.hubei.gov.cn/wjfb/dtyw/201910/t20191025_7921.shtml.

[26] Hubei Ready-mixed Concrete Industry Association, Memberships of Hubei Ready-mixed Concrete Industry Association Attend Antitrust Training, https://mp.weixin.qq.com/s/mZynkOZGAjOMP2JX6pGY5A?scene=25#wechat_redirect.

[27]Chen Sicun, Concrete collusion has been investigated, HSW.cn, December 18, 2019, A8.

[28]Guangdong AMR, Guangdong AMR Holds Opening Hearing for Concrete Collusion, http://amr.gd.gov.cn/zwdt/xwfbt/content/post_2661135.html.

[29] Fang Wangzhu, Concrete Company’s Wechat Official Account Deletes Antitrust Clues After Exposing Concrete Price Collusion, http://www.caixin.com/2019-07-19/101441782.html.

[30]See (2018) Gui 01 Min Chu No.1190, http://wenshu.court.gov.cn/website/wenshu/181107ANFZ0BXSK4/index.html?docId=352353f8cc40460c98e2ab2a00dcff1e and (2018) Gui 01 Min Chu No.1191, http://wenshu.court.gov.cn/website/wenshu/181107ANFZ0BXSK4/index.html?docId=83221097ec184237a267ab2a00dd9ea4.

China Antitrust Review 2019 (2/4): Gun-jumping Cases

China Antitrust Review 2019 (3/4): Conditional Approvals of Merger Filings

Professionals

Practices