According to recent data[1] released by China’s State Administration for Market Regulation (“SAMR”), a total of 465 merger filings were closed in 2019. Only five cases were cleared conditionally, which accounts for only about 1% of the closed cases.

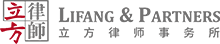

In fact, conditional approvals have always accounted for only a small proportion of merger filing cases each year. Since the Anti-Monopoly Law coming into force, SAMR (and previously, Ministry of Commerce) approved a total of 44 cases conditionally and prohibited two proposed transactions. As shown in Figure 1 below, the number of conditional approvals and prohibitions in each year is single-digit. Therefore, the number of conditional approvals in 2019 is above average.

Figure 1: 2008-2019 Number of conditional approvals and prohibitions

I. Review of 2019 conditional approvals

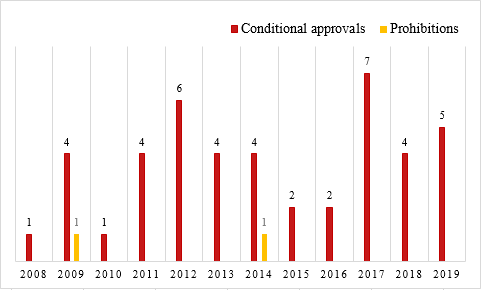

The basic information of the five cases is shown in Table 1 below.

Table 1-2019 Summary of 5 conditional approvals

As shown in Table 1 above, the average review period was 393 days from the initial submission to the final clearance, ranging from 263 days for II-VI’s acquisition of Finisar to 552 days for the JV between Garden Biochemical and Royal DSM. The five cases scattered in high-tech industries such as semiconductors and optical communications, as well as traditional industries including marine equipment, pharmaceuticals, and aluminum products.

Each of the five conditional approvals will be discussed in turn based on the decisions published by SAMR.

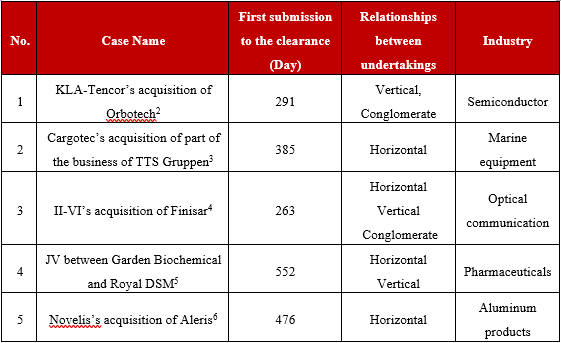

A. KLA-Tencor/Orbotech

On February 13, 2019, SAMR approved the acquisition of Orbotech Ltd. (“Orbotech”) by semiconductor company KLA-Tencor Corporation (“KLA-Tencor”) with conditions. According to the agreements between two parties, KLA-Tencor acquired all shares of Orbotech in the form of cash and share exchange. From the first submission on April 28, 2018, to the clearance, it took 291 days. The timeline of review is shown below.

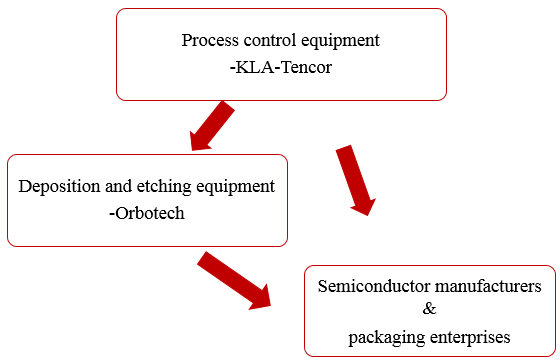

KLA-Tencor and Orbotech are both semiconductor technology companies listed in the United States. The parties had multiple vertical and adjacent relationships in the broader market for process control equipment, deposition and etching equipment. Their relationships are shown below:

We can see from the above figure, semiconductor manufacturers and packaging enterprises in the downstream market highly depend on process control equipment manufacturers, and deposition, etching equipment manufacturers. KLA-Tencor is the largest competitor with a market share of over 50% in both global and Chinese markets for process control equipment. And Orbotech plays an important role in the market of packaging deposition, etching equipment.

SAMR concludes that the entity post-transaction would have the ability to impose vertical foreclosure. KLA-Tencor would be able to extend its advantage into downstream markets and Orbotech may leverage KLA-Tencor’s advantage to exclude or restrict the competition in the market of deposition and etching equipment market. Thus, SAMR approved the transaction subject to the following remedies: KLA-Tencor and Orbotech shall continue to supply process control equipment and services to downstream Chinese manufacturers on fair, reasonable and non-discriminatory (“FRAND”) terms within five years; they shall not impose tying or additional unreasonable transaction terms and Orbotech shall not obtain competitively sensitive information about other Chinese manufacturers of deposition and etching equipment.

B. Cargotec/TTS Gruppen

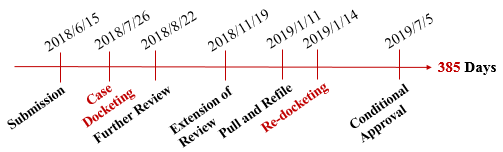

On July 5, 2019, SAMR conditionally approved Cargotec Corporation (“Cargotec”)’s proposed acquisition of part of the business of TTS Gruppen (“target business”). According to the agreements between two parties, Cargotec would acquire the target business and integrate it with one of its subsidiaries. From the first submission on June 15, 2018, to the clearance, it took 385 days. The timeline of review is shown below.

The proposed acquisition involves marine equipment markets, in which the parties had horizontal overlaps. Both parties ranked in top 2 or top 3 in Chinese hatch covers, merchant ship roll-on/roll-off (Ro/Ro) equipment and cargo crane markets. After review, SAMR identified competition concerns in these three markets that the post-merger entity would have a combined market share of over 50% in each of the markets, and gain stronger control of price unilaterally, which would result in fewer choices of downstream enterprises and damaged interests. In addition, SAMR concludes it is difficult to establish effective competition constraints although there are potential entrants in relevant markets. Thus, SAMR imposed a range of behavioral remedies, including a hold-separate remedy that Cargotec and TTS shall hold their businesses separate in China for two years and shall set up firewalls to ensure independence. They also shall not increase price unfairly, refuse to deal, and maliciously delay in delivery, etc.

C. II-VI/Finisar

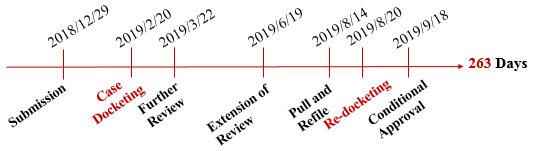

On September 18, 2019, SAMR granted its conditional approval of II-VI Incorporated (“II-VI”)’s proposed acquisition of Finisar Corporation (“Finisar”). On November 7, 2018, II-VI signed an agreement with Finisar to acquire Finisar’s equity in cash and through equity swap. From the first submission on December 29, 2018, to the clearance, it took 263 days. The timeline of review is shown below.

This case is the one with the shortest review period with only one pull and refile. The formal re-docketing of the refile only took 6 days, which was very efficient.

In terms of the parties’ business relationships, they had horizontal overlaps, vertical relationships, and both were also active in adjacent markets. SAMR finds that II-VI and Finisar ranked No. 2 and No. 3 in the global and Chinese wavelength-selective switch (“WSS”) markets. WSS market is highly concentrated with a combined market share of 95% by the top three competitors. If the transaction was cleared, the combined entity would have a relatively high market share of 45%-50%, which would eliminate the competition constraints between II-VI and Finisar. Due to market entry barriers, it is very difficult for new entrants to establish effective competition constraints in a short period. Thus, to address these competition concerns, SAMR required the parties to a hold-separate remedy for three years, as well as setting up firewalls to prevent exchanging competitively sensitive information. Moreover, the parties shall continue supplying WSS on FRAND terms without discriminatory treatment.

D. Garden/Royal DSM

This transaction is the joint venture (“JV”) between Netherlands-based Royal DSM listed in the United States and China’s Zhejiang Garden Biochemical High-Tech Co., LTD. (“Garden Biochemical”), which is the only conditional case involving Chinese companies among the five in 2019.

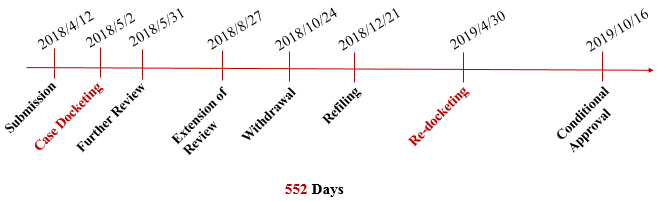

The case was first filed on April 12, 2018, and was asked to pull and refile in the course of review. Finally, SAMR approved it conditionally on October 16, 2019, lasting a record-breaking review period of 552 days. The timeline of review is shown below.

As shown on the above figure, the Garden/Royal DSM case was pulled and refiled only once, but it still took 76 days longer than the Novelis/Aleris case, which was pulled and refiled three times (see details in the next section). Based on our observation of other conditional approvals in 2019, the refile usually is done within few days after withdrawal, and then re-docketed by SAMR in 10 days (if a simple case is refiled under normal procedures after withdrawal, the re-docketing may take a little longer). Therefore, it is surprising that it took nearly two months for Garden/Royal DSM to refile on October 24, 2018, and nearly five months for the case to be accepted/re-docketed. SAMR did not disclose further details on this point in its decision.

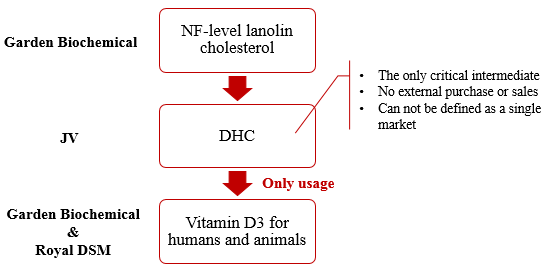

The relevant markets are the vitamin D3 markets for humans and animals (downstream) and the NF-level lanolin cholesterol market (upstream). The relationships of undertakings are shown below.

In general, defining relevant markets in case of establishing JV starts with the proposed business scope of the JV. Naturally, the product of the JV is defined as a relevant market. However, this transaction is distinguished as JV’s DHC was an intermediate product from raw materials to terminal products, which was not purchased or sold externally, and it could not be defined as a single market in the case. SAMR identified three relevant markets, namely upstream NF-level lanolin cholesterol and downstream vitamin D3 for humans and vitamin D3 for animals, not including JV’s products DHC.

The parties were top 3 suppliers of vitamin D3 for humans and animals. Due to the high combined market share, high market concentration, and entry barriers, SAMR concludes the transaction would further strengthen their market powers and enhance market concentration and the barrier to entry. In addition, Garden may likely leverage its high market shares of over 50% in the global and Chinese markets for NF-level lanolin cholesterol to integrate up and downstream markets, which gave rise to competitive concerns. To address these concerns, SAMR required a comprehensive set of behavioral remedies that in horizontal overlaps, the parties shall keep their vitamin D3 businesses completely independent for five years. In vertical overlaps (NF-level lanolin cholesterol market), they shall not reach agreements that Royal DSM must purchase all cholesterol needed to produce vitamin D3 from the Garden Biochemical. The parties also shall commit to ensuring the independent operations of the JV.

E. Novelis/Aleris

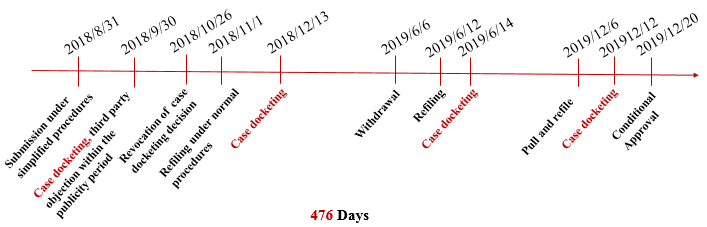

On August 31, 2018, U.S. aluminium producer, Novelis, filed a notification to SAMR regarding its proposed acquisition of rival Aleris. From the first submission to the clearance, the applicant refiled the notification thrice. Finally, SAMR approved it with conditions, taking 476 days. The timeline of review is shown below.

In the beginning, the notifying party filed this transaction under simplified procedures but encountered third party objection within the publicity period. Then the notifying party refiled under normal procedures. Later, due to the time limit of the review, it withdrew and refiled the case twice. The process was tortuous. Finally, SAMR approved it with conditions on December 20, 2019.

SAMR identified two relevant markets for interior and exterior aluminium auto-body sheets. Novelis and Aleris were close competitors, ranking No. 1 and No. 3 respectively. Considering these markets are highly concentrated, the entry barrier is high and the number of suppliers is limited, SAMR concerns the transaction would reduce existing direct competitors and further enhance the concentration. Thus, to address these concerns, SAMR required Aleris to divest its interior and exterior aluminium auto-body sheet businesses in the European Economic Area; the combined entity shall refrain from supplying cold rolled plates to any competitors that operate in the market for auto-body sheets for the longest period of 10 years. It is worth noting that this transaction is the only one in 2019 that SAMR used structural remedies to address competition concerns.

II. Features of conditional clearances

Regarding conditional approvals, although they involve different industries and transaction parties, there are also some similarities.

A. Megamerger of giants in highly concentrated industries

A total of 44 conditional clearances and 2 prohibitions since 2008 concern industries of semiconductor, health and medicine, automobile, aviation, communication, mining, etc. These markets are featured by only a few major competitors with high market share, while the market share of minor competitors, if any, is much lower. In addition, the barriers to entry are high. New entrants may need huge capital investment or high technology to enter into the relevant markets. Even if entry is possible, new entrants cannot compete effectively without continuous and enormous investments. Merger filings cases often occur between the giants in practice. Taking conditional approvals in 2019 for example, all undertakings are ranked top 3 in relevant markets. These enterprises have strong market power before the transaction, thus any merger, equity acquisition or establishment of JV among them could naturally draw the attention of the antitrust authority and increasing chance of remedies.

Thus, when enterprises are in highly concentrated markets and have strong market power, regardless of dealing with competitors or downstream and upstream companies, make sure you have assessed the antitrust risk of such transaction, either by yourself or by your Chinese external antitrust counsel, and develop strategic plans in advance.

B. Additional review time provided by “pull and refile”

The average time of clearance (from the submission of notification documents and materials to the clearance) for the five conditional approvals was 393 days, ranging from 263 days to 552 days. The Anti-Monopoly Law provides statutory timelines by which the merger review processes have to be completed within 180 days after case acceptance (case docketing). Amongst the five cases, none of them was cleared within the maximum statutory review timeline, even deducting the period from the submission to case docketing. In practice, it is hard to clear the conditional cases within the statutory review timeline due to the complexity of the deal, the cautious approach taken by SAMR, negotiation of remedies and short of case handlers. According to public decisions, pull and refile has long been as a practical solution.

On January 2, 2020, SAMR issued the Draft Amendment to the Anti-Monopoly Law (“Draft Amendment”) . The Draft Amendment (Article 30) now adds the stop-the-clock mechanism that the clock for the following statutory timelines can be stopped: (1) on the application of or consent by the notifying party; (2) in the course of submitting supplemental documents and materials at the request of the antitrust authority; (3) during remedy discussions with the antitrust authority. If the amendment comes into force, the notifying party will not be required to “pull and refile” its notification before the time limit to restart the statutory timelines.

[1]See Wu Zhenguo, Promote Fair Competition and Serve Reform Development: The Overview of Antitrust Work of 2019, China Market Regulation News, February 20, 2020, http://www.cicn.com.cn/zggsb/2020-02/20/cms123961article.shtml.

[2]See http://gkml.samr.gov.cn/nsjg/xwxcs/201902/t20190220_290940.html.

[3]See http://www.samr.gov.cn/fldj/tzgg/ftjpz/201907/t20190712_303428.html.

[4]See http://www.samr.gov.cn/fldj/tzgg/ftjpz/201909/t20190920_306948.html.

[5]See http://www.samr.gov.cn/fldj/tzgg/ftjpz/201910/t20191018_307455.html.

[6]See http://www.samr.gov.cn/fldj/tzgg/ftjpz/201912/t20191220_309365.html.

[7]See http://www.samr.gov.cn/hd/zjdc/202001/t20200102_310120.html.

China Antitrust Review 2019 (1/4): Investigations

Professionals

Practices