It has been a decade since the conclusion of China’s first antitrust civil litigation, Li Fangping vs. China Netcom Beijing Branch. With the publishing of the Provisions of the Supreme People’s Court on Several Issues Relating to Laws Applicable for Trial of Civil Dispute Cases Arising from Monopolies and the Supreme People’s Court (“SPC”)’s public trial of Qihoo vs. Tencent for abuse of dominance case, China’s practice on civil antitrust litigation has undergone steady development featured by increasing complexity and sophistication despite of the slight annual increase of number of antitrust civil litigations during this decade.

Remarkable performances in the establishment of rules and the practice of trial hearing of antitrust civil litigation were presented in 2019. According to the public resources, acceptance and hearing information of 77 cases relating to antitrust disputes were published by national courts system in 2019 through wenshu.com, tingshen.court.gov.cn, and official Wechat accounts, and near half of these cases were newly accepted in 2019. Excluding 35 cases relating to the internet domain name, a total of 42 antitrust civil litigations were newly accepted or heard in 2019, which is steady compared with past years. Overall, we observed that state-owned enterprises (“SOEs”) were the vulnerable targets for being sued for abuse of dominance during the last year and the exclusive dealing by e-commerce platforms attracted broad public attention in 2019. Regarding procedural rules, we observed that the jurisdiction of antitrust cases experienced tremendous change after the formal launch of the “leapfrog” system and SPC demonstrated its attitudes for the first time regarding the arbitrability of antitrust disputes.

I. State-own Enterprises Frequently Sued for Abuse of Dominance

According to the publicly available information, 8 abuse of dominance cases involve national SOEs or regional SOEs in 2019, and the alleged violations include discriminatory treatment, tying and refusal to deal. The table below shows the basic information of each case.

Table 1 – State-owned Enterprises Sued for Abuse of Dominance in 2019

It was worth noting that Nanning Intermediate People’s Court issued two antitrust civil judgments in favor of plaintiffs in 2019, Wu Zongqu vs. Yongfu Water Supply Co., Ltd. for abuse of dominance case and Wu Zongli vs. Yongfu Water Supply Co., Ltd. for abuse of dominance case[1].

In the past years, plaintiffs in antirust civil litigation have been facing difficulty in providing sufficient evidence and winning a case. Especially in abuse cases, plaintiffs usually bear the burden of proof for market definition, dominance, abusive behaviors and actual damages. In these abovementioned cases, the court defined the relevant market as the urban public water supply service market in the area of Yongfu. Giving the defendant had market share in this market, the nature of natural monopoly of public enterprise, market entry and the reliance of users on the defendant, the court holds the defendant has a dominant market position. In addition, the tying practice conducted by the defendant was easily proved through the water supply contract, notification for water supply and invoices provided by the plaintiff. The court’s reasoning followed the general framework for defining dominance under the Anti-Monopoly Law (“AML”) and the burdens of proof bored by the plaintiff were mitigated because of the nature of relevant market.

II. Internet “Either or restriction” Draws Broad Attentions

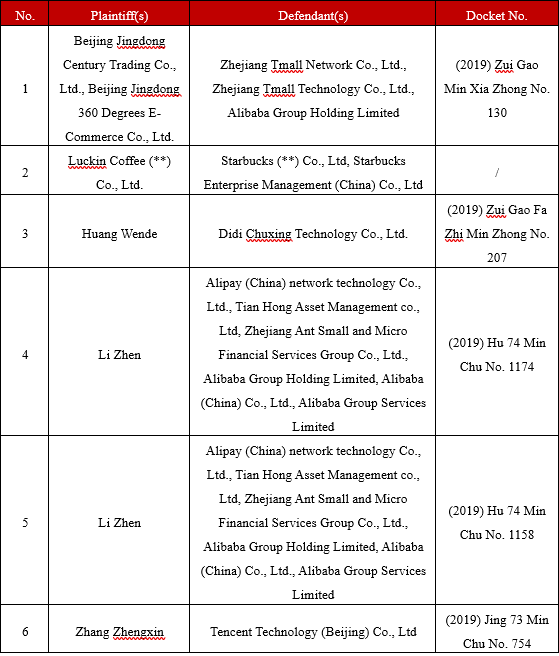

According to public information, a total of 6 antitrust civil litigations were filed in connection with internet companies, and illegal behaviors involved in these cases contained exclusive dealing, discriminatory treatment, refusal to deal and abuse of dominance. The table below shows basic information of each case.

Table 2 – Internet Industry Antitrust Civil Litigations in 2019

Among these cases, the exclusive dealing of e-commerce platforms has drawn much public attention. In fact, JD.com (“JD”) had filed a complaint to the State Administration for Industry and Commerce against Tmall’s exclusive dealing behaviors as early as 2015. Later, JD formally sued Tmall against its abusive behaviors before Beijing High People’s Court in 2017, for damages of 1 billion RMB. JD and Tmall have been battling over jurisdiction since then. Recently, the SPC issued a second-instance ruling on the jurisdiction in July 2017 and confirmed Beijing High People’s Court’s jurisdiction over this case, which ended the dispute over jurisdiction. It means the case moved on to the stage of substantive hearing.

Later, JD further filed an application to Beijing High People’s Court before the beginning of 11.11 shopping festival and asked the court to join two other e-commerce platforms, i.e., Vipshop (VIP.com) and Pinduoduo, as third parties without an independent claim. On the same day, Vipshop and Pinduoduo filed applications to Beijing High People’s Court to join the litigation voluntarily[2]. Meanwhile, Guangdong Galanz Life Electric Commercial Co., Ltd. announced that it had filed antitrust litigation against Tmall before Guangzhou Intellectual Property Court on October 28, 2019, and its complaint was accepted by the court on November 4, 2019[3], which further escalated the dispute around exclusive dealing by e-commerce platforms.

Regarding this issue, China’s State Administration for Market Regulation (“SAMR”), the antitrust authority in China, in the Administrative Guide Meeting for Standardizing Online Operation in Hangzhou, commented that exclusive dealing was explicitly prohibited under E-commerce Law, AML and Anti-Unfair Competition Law. Such violations undermined fair competition and consumer’s interest. The authorities would closely watch the development and initiate an antitrust investigation, if appropriate according to the law[4]. Therefore, more detailed and specific guidance can be expected from the courts and antitrust authority.

III. First Year of “Leapfrog Appeal” System: Rules and Practices

On December 28, 2018, SPC published the Regulation of the Supreme People’s Court on Several Issues Concerning Intellectual Property Court (“Regulation”) (Fa Shi [2018] No.22). According to the Regulation, SPC establishes the Intellectual Property Tribunal to take charge of appeals of technical IP cases (including patent cases) and antitrust cases. From 2019, the Intellectual Property Tribunal of SPC can directly hear appeals from the first-instance antitrust judgments or rulings rendered by intellectual property courts or intermediate courts, omitting high courts, which were formerly the appeal courts. In the meantime, the local courts that had been approved by SPC to accept first-instance civil and administrative antitrust cases cannot accept aforesaid cases under the Regulation. With the effects mentioned above, the “leapfrog appeal” system was formally established in China.

The Regulation came into effect on January 1, 2019, and the Intellectual Property Tribunal of SPC openly heard Huang Wende vs. Didi Chuxing Technology Co., Ltd. for abuse of dominance case on September 24, 2019. The first instance court of this case was Zhengzhou Intermediate People’s Court and the Intellectual Property Tribunal of SPC directly took charge of the appellate case, omitting Henan High People’s Court. This is the first antitrust appeal case publicly heard by SPC, setting a milestone in applying the “leapfrog appeal” rule in hearing antitrust cases.

Considering the complexity and expertise required for most antitrust cases, the application of the “leapfrog appeal” rule would unify the judicial standards, control and improve the judgment quality of antitrust cases, since the appeal is centralized by the Intellectual Property Tribunal of SPC.

IV. SPC First-time Objects the Arbitrability of Antitrust Disputes

The arbitrability of antitrust disputes has been controversial for a long time. In 2016, Jiangsu High People’s Court denied the arbitrability in Nanjing Songsue Technology Company vs. Samsung (China) Investment Co., Ltd[5]. Lacking explicit laws, the court denied the arbitrability of antitrust disputes. It held that although arbitration clauses were agreed by both parties, such agreements should follow the relativity of contract, and the dispute between both parties involved third parties, consumers and public interests, the impact of which went beyond both parties. After that, a similar decision was also given by Shenzhen Intermediate People’s Court in the relevant case.

However, the answer to the arbitrability of antitrust disputes given by the Beijing High People’s Court in 2019 was the opposite.

In July 2019, Beijing High People’s Court mentioned in the second instance ruling on the dispute over jurisdiction in Shanxi Changlin Co., Ltd. vs. Shell (China) Co., Ltd for abuse of dominance case that the arbitration clauses contained in the distribution agreement were written in such a general way that any dispute in connection with the generation of rights and obligations, the exercise of rights and the performance of obligations arising from the distribution agreement were covered. The court held that the abusive behaviors alleged by the plaintiff were indeed disputes raised from the performance of the distribution agreement thus the arbitration clauses were applicable.

Later in August 2019, SPC ruled oppositely in Hohhot Huili Material Co., Ltd. vs. Shell (China) Co., Ltd, a horizontal monopoly agreement case[6]. SPC held that antitrust disputes cannot be covered by arbitration because antitrust disputes involved not only the interests of both parties, but also the public interests, given the nature of public law, and went beyond the scope of dispute resolution clause between the parties. Given the lack of explicit laws, the ruling issued by SPC explicitly demonstrated that the arbitration clauses contained in the contract could not per se prevent courts from hearing horizontal monopoly agreement cases[7] and also provide an important guideline on judicial practices regarding the arbitrability of antitrust disputes.

Professionals

Practices